What Are Statutory Accounts?

All limited companies in the UK are obligated to present their financial statements, also referred to as “Annual Accounts” or “Year-end Accounts,” to Companies House within nine months of the completion of their fiscal year. In comparison to larger businesses, small companies’ financial statements are simpler to prepare.

What’s included in statutory accounts?

What information do statutory accounts include?

he Statutory Accounts that Limited Companies in the UK prepare must be fully in accordance with either the International Financial Reporting Standards (IFRS) or the Generally Accepted Accounting Practice (UK GAAP). Such accounts usually comprise the following components:

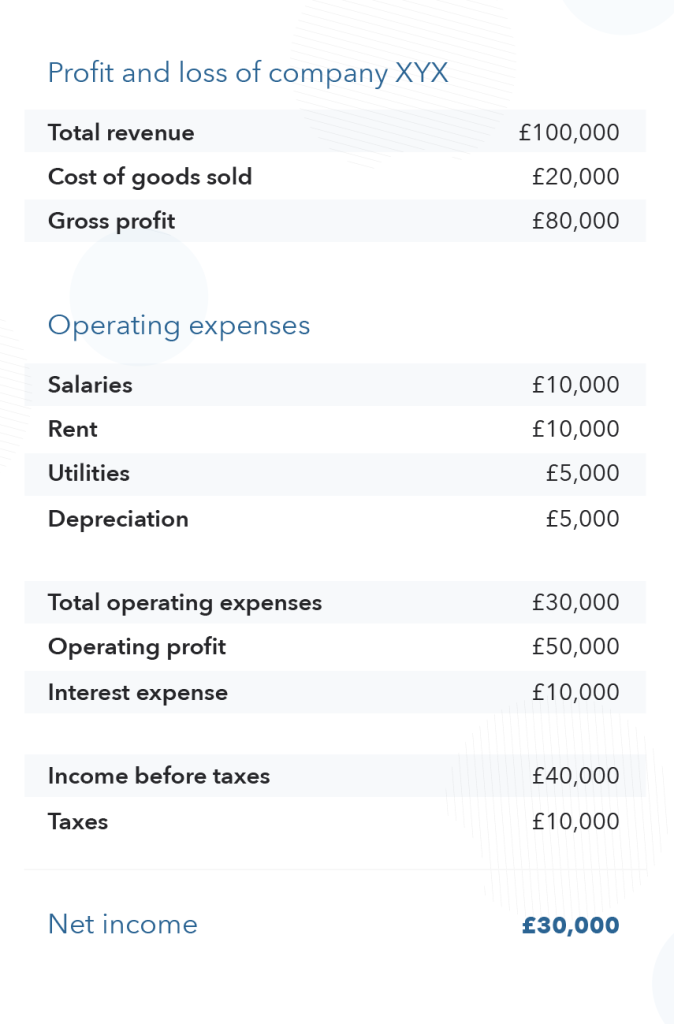

01. Profit & Loss (P&L) Account

The Profit & Loss (P&L) statement represents the company’s performance throughout the fiscal year, summarizing the income received and the expenses incurred. However, since each business is unique, the components of the P&L may vary.

In addition to the P&L, most companies must also file a Company Tax Return with HMRC annually, reporting their earnings, losses, loans, and other factors that may affect their tax obligations.

For instance, a retail business with several stores may prefer to have its income and expenses categorized by each location. In contrast, a construction business may want to evaluate the profitability of each project they undertake.

Thus, the P&L report prepared for management should be customized to suit the company’s nature, level of detail required, frequency, and layout.

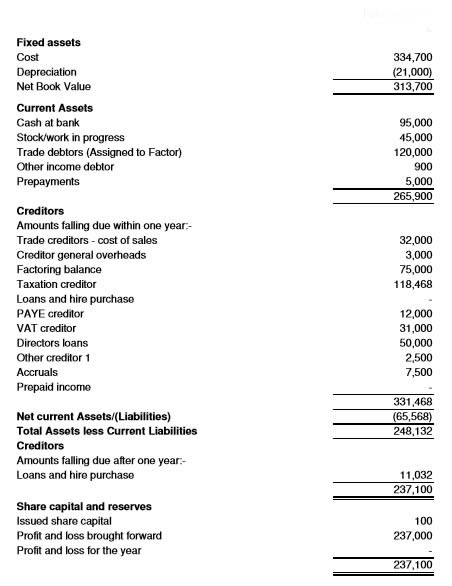

02. Balance sheet

A Balance Sheet presents a snapshot of a company’s financial status at a particular moment in time. Along with its primary purpose of providing an overview of the company’s assets, liabilities, and equity, a Balance Sheet can also be useful in determining critical business ratios that help to identify risk areas.

Such ratios may include liquidity ratios, debtor days, inventory days, and others. By incorporating notes that indicate these key ratios, businesses can have a better understanding of their financial health and plan accordingly for any potential cash flow needs.

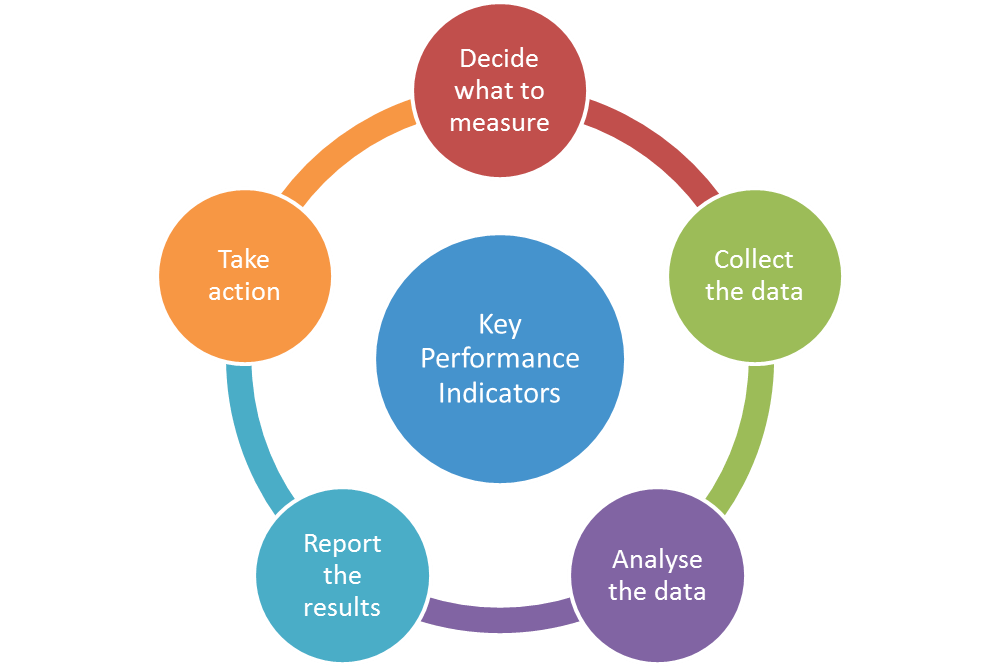

03. Key performance indicators (KPI's)

04. Directors report

Under the Companies Act 2006, larger companies must include a Director’s Report in their Annual accounts to enhance corporate transparency. This report outlines the company’s principal activities, significant events that occurred during the year, and their business impact.

The Director’s Report provides an opportunity for companies to provide more extensive details regarding their performance throughout the year, including any regulatory impacts or changes in the economic outlook. The report may also mention the company’s intention to pay dividends.

05. Auditors report

The Auditor’s Report is necessary only for companies that undergo an Audit, either as a Compulsory or Voluntary Audit, and is conducted by the company’s auditors. Following a thorough examination, the auditors will determine whether the financial statements accurately represent the business’s financial position.