What is a cash flow forecast?

Preparing a three-way cash flow forecast

Three-way forecasting integrates profit and loss, balance sheet, and cash flow data to provide a comprehensive overview of your financial position. By combining assets, expenses, and cash flow figures, you can generate financial forecasts that outline the potential of your business model, which is precisely what banks or investors seek when financial assistance is required.

Now, let’s delve into how cash flow interacts with your profit and loss statement and balance sheet, and explore how you can optimize financial forecasting and future planning by leveraging the insights derived from all three reports.

Understanding your profit & loss (P&L)

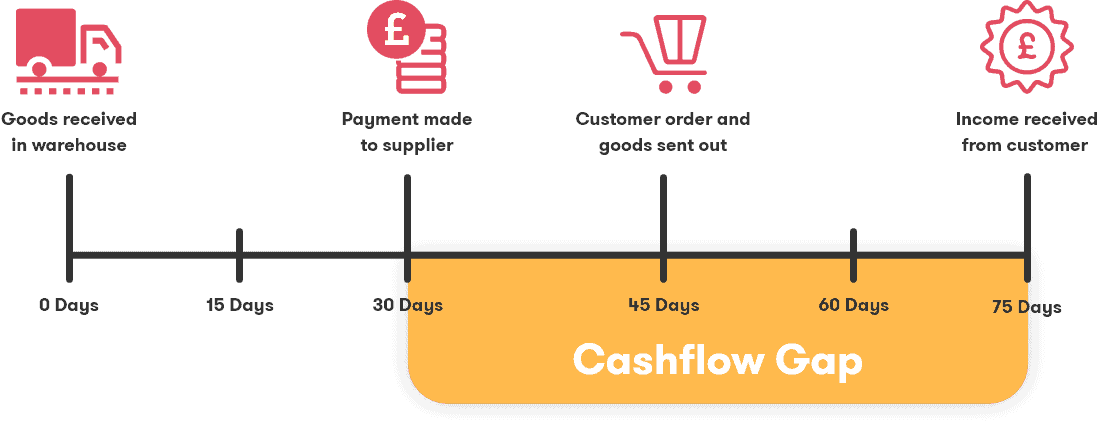

Why cash flow management is important – an example